Notaries have a serious job. Anytime you're dealing with situations involving the law, deadlines, terms of a contract, people count on you to perform your duties correctly the first time.

Notaries are responsible for making documents official in the eye of corporations and courts so the parties involved do not have to be called in to verify their signatures.

State government licensing departments - or counties - require notaries to get bonded because there are many opportunities a notary can act in bad faith or be influenced by third parties to commit fraudulent acts.

This article will cover:

A notary bond is a surety bond. A surety bond is proof of financial responsibility purchased by a service provider (the notary). It's required by the state licensing authority for the benefit of your customers in case you act in bad faith while carrying out your notary responsibilities.

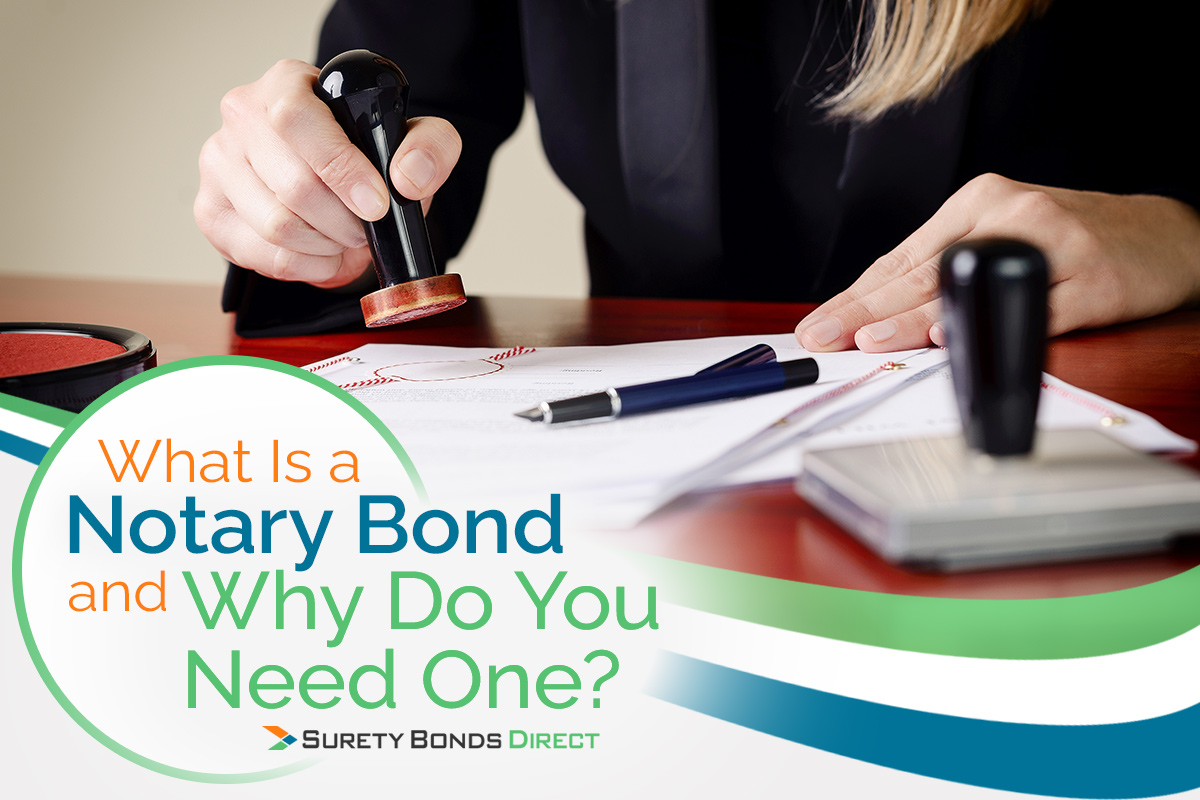

There are three main parties in a surety bond arrangement.

The state licensing authority is called the Obligee.

The state requires licensing and for notaries to follow the rules set forth by the license. These rules are changing fast with the advent of electronic notarization.

The Obligee requires this bond to protect the public from negligence on a notary's behalf. So while the Obligee is defined as the party who receives the benefit of a surety bond, in most cases, the Obligee is a government department acting on behalf of the end customer or client.

The surety company is called the Surety.

The surety company is a special insurance company who provides the bond. If legitimate claims against the bond occur, the surety guarantees payment to the affected party.

The notary is called the Principal.

The notary is required to purchase this bond as proof of financial responsibility to their clients.

If the notary were to ever damage their clients in any way, the client can make a claim against the bond. If the claim is paid out, the notary is required to pay back the surety company the amount of the claim.

Purchasing a notary bond is for the protection of the businesses, the courts, and people you will be providing services for.

A notary bond is not an insurance policy, although it can be confusing differentiating between a surety bond vs insurance. Notaries are required to carry a special type of liability insurance. More on this insurance policy below.

Getting a notary bond is an easy and fast process. At Surety Bonds Direct, we sell notary bonds at low fixed prices and most bonds can be instantly downloaded.

Learn more about how much is a notary bond and get yours today.

All evidence in court needs to be approved by the judge and it needs to be legitimate.

Notarized signatures are assumed to be authentic by legal authorities like judges. A judge won't question the validity of a signed affidavit with a notarized seal.

If a document were missing a notarized seal, the judge could demand the two parties who signed the document to appear in court and prove the validity of the document. Notarizing evidentiary documents saves considerable time in the court process.

The notary has the power to falsify notarized documents. This can affect a case or arbitration in unseen ways. Falsifying notarized documents is a serious offense that will cause more than just a claim against your bond.

Not all wills are drawn up by an attorney. There are many cases in which a client will present a notary with a self prepared will and ask:

Which notarization is required?

And for the notarization to be complete.

It doesn't matter what type of document is being notarized, a notary is never allowed to consult on the type of notarization required. In the case where the client is requesting notarization for a self prepared will, the notary should insist on the client seeking the help of an attorney.

In states like North Carolina and New York, a will does not have to be notarized to be accepted in court. However, when a will is presented in court and it's not notarized, the judge will require the presence of the witnesses who signed the will during its creation. This could slow down the court process.

In these states, attorneys recommend a "self-proving will." This is a self created will notarized with the creator of the will and the witnesses present. A "self-proving will" will be accepted in court without the in-person proof of the witnesses as they were present when the document was notarized.

When transferring the deed of a piece of property, the execution of the deed must be acknowledged before a notary.

There have been many fraudulent cases where fake deeds of real estate have been notarized and recorded in state records. After the deed is recorded the new owner would live in the house, flip it, or rent it out.

A notary who wittingly commits deed fraud would be in trouble and so would an unwitting notary. Notaries have been tricked by fake phone calls posing as property owners. A notary should never notarize a deed without the original owners and new owners being present.

While there are various types of mortgage fraud, here is a unique way a notary can get in trouble.

Mortgage rates fluctuate and before a mortgage can be locked in, it must be notarized with the signatures of the party accepting the mortgage. If the mortgage is not notarized, it's supposed to be invalid.

If the notary was late to the meeting where they notarize a mortgage the party obtaining the mortgage can lose out on the rate secured in the document. This would be negligence on the notary's part for causing a notarization to be late or postponed.

A mistake like this can cost the borrower hundreds to thousands of dollars per year.

Notaries have a lot of responsibility and a lot can go wrong depending on the parties involved in the notarization process. It's easy for a notary to get caught up in an act of fraud and not know it.

This is why notaries have insurance called Errors and Omissions insurance.

What is protected by these policies varies by the insurer, but broadly speaking these policies cover:

These policies do not cover intentional acts of fraud or wrongdoing.

The main difference is one is an insurance policy and one is a surety bond. The biggest difference between a surety bond and an insurance policy is the beneficiary.

A surety bond (notary bond) protects the businesses, courts, and individuals from any negligent or damaging behavior on the notary’s part.

An E&O insurance policy is purchased to protect the notary from unwitting negligence or unforeseen damages. Insurance policies involve two parties, the insurance company and the purchaser requiring protection from unforeseen events.

Notarized documents, contracts, and evidence are vital to the parties requiring them. The effects of improperly notarizing documents can be great. Learn what your notary bond cost will be and how much your state charges. If you have questions or need the help of a bond expert, please call us at 1-800-608-9950.

Justin Richmond

published: December 7, 2022More Surety Bond Details for: